tax is theft bitcoin

If cryptocurrency such as Bitcoin is stolen by hackers tax relief may also be available. With your new-found wealth you decide to buy a 20000 car using your 1 BTC.

Bitcoin Taxes How Is Cryptocurrency Taxed In 2021 Picnic

If you owned your bitcoin for more than a year you will pay a long-term capital gains tax rate on your profit which is determined by.

. If youre actively trading crypto or if your activities unintentionally qualify you as a day trader youll be liable to income taxes. Tax is theft bitcoin Sunday June 26 2022 Edit. If cryptocurrency such as Bitcoin is stolen by hackers tax relief may also be available.

If you acquired a Bitcoin or part of one from mining that value is taxable immediately. Tax Rules for Bitcoin and Others. Income tax rates in Malaysia range from 3 to 30.

B The remaining loss is only deductible to the extent it exceeds 10 of the persons adjusted gross income. In this case you will be able to claim a capital loss because now the coin is worthless. But these issues are separate from describing taxes as theft.

However much like casualty losses theft losses no longer qualify for deductions on Form 4684 thanks to the Tax Cuts and Jobs Act. There are other ways to work around. The IRS treats Bitcoin.

Similarly states often spend money in wasteful or distorting ways that are worthy of criticism and some taxes are the product of. Cryptocurrency Is Treated As Property. By June 1st the price of Bitcoin has doubled to 20000.

The IRS has made it mandatory for taxpayers to report bitcoin. The short answer to that question is yes. Bitcoins classification as an asset makes its tax implications clear.

In all cases organized books and records are a necessity. From a logical perspective you would think the income you recognized and the loss. In all cases organized books and records are a necessity.

WAKEY WAKEY Since the lockdowns of March 2020 a lot of us have had time to look around and ask ourselves what is going on like what in the hell is really going on. Examples of casualties that you would not. In the case of cryptocurrency anytime you negligently lose your cryptocurrency it would be a casualty that is not deductible for tax purposes.

For someone with a 25000 in gross income and a 5000. Lets take a look at how to report stolen scammed and lost tokens on your taxes. What you may not realize is that the moment you send.

In essence two parties make a bet. If you disposed of or used. No need to sell the currency to create a tax liability.

Under the current tax law this situation is a personal casualty loss which is no longer tax-deductible. If you have purchased Bitcoin and later used it to pay for goods and services sold it for a profit or if you received the Bitcoin through mining youll owe taxes. Crypto theft and scams are on the rise but only some of these losses are tax-deductible.

When investors buy and sell Bitcoin futures contracts they are speculating about BTCs future price. If you have suffered losses as the result of theft. New York defines bitcoin sales tax the same way by finding the value of the cryptocurrency or CVC used at the time of purchase and applying that to the value of the CVC.

So if youve lost your private keys sent your crypto to the wrong address or otherwise lost your crypto due to negligence you cannot deduct this as a capital loss. Now he admitted that for the higher tax brackets the amount added by the company doesnt compensate for your entire tax burden but at lower levels it accounts for. One believes the BTC will go up in price.

If you have suffered losses.

Crypto Taxes How To Calculate What You Owe To The Irs Money

Cryptocurrency Tax Guide 2022 How Is Crypto Taxed In The Us

Cryptocurrency Taxation Here S What You Need To Know Cnn Business

Mendoza Tax Administration Starts Taking Crypto Payments For Taxes And Fees

Cryptocurrency And Taxes Cryptocurrency Tax Podcasts

Price Of Bitcoin Btc 2009 2020 Bitcoin Crypto Currencies Money

How Is Cryptocurrency Taxed Forbes Advisor

Taxation Is Theft Sticker By Bexkelly Theft Vinyl Sticker Stickers

Cryptocurrency Taxes What To Know For 2021 Money

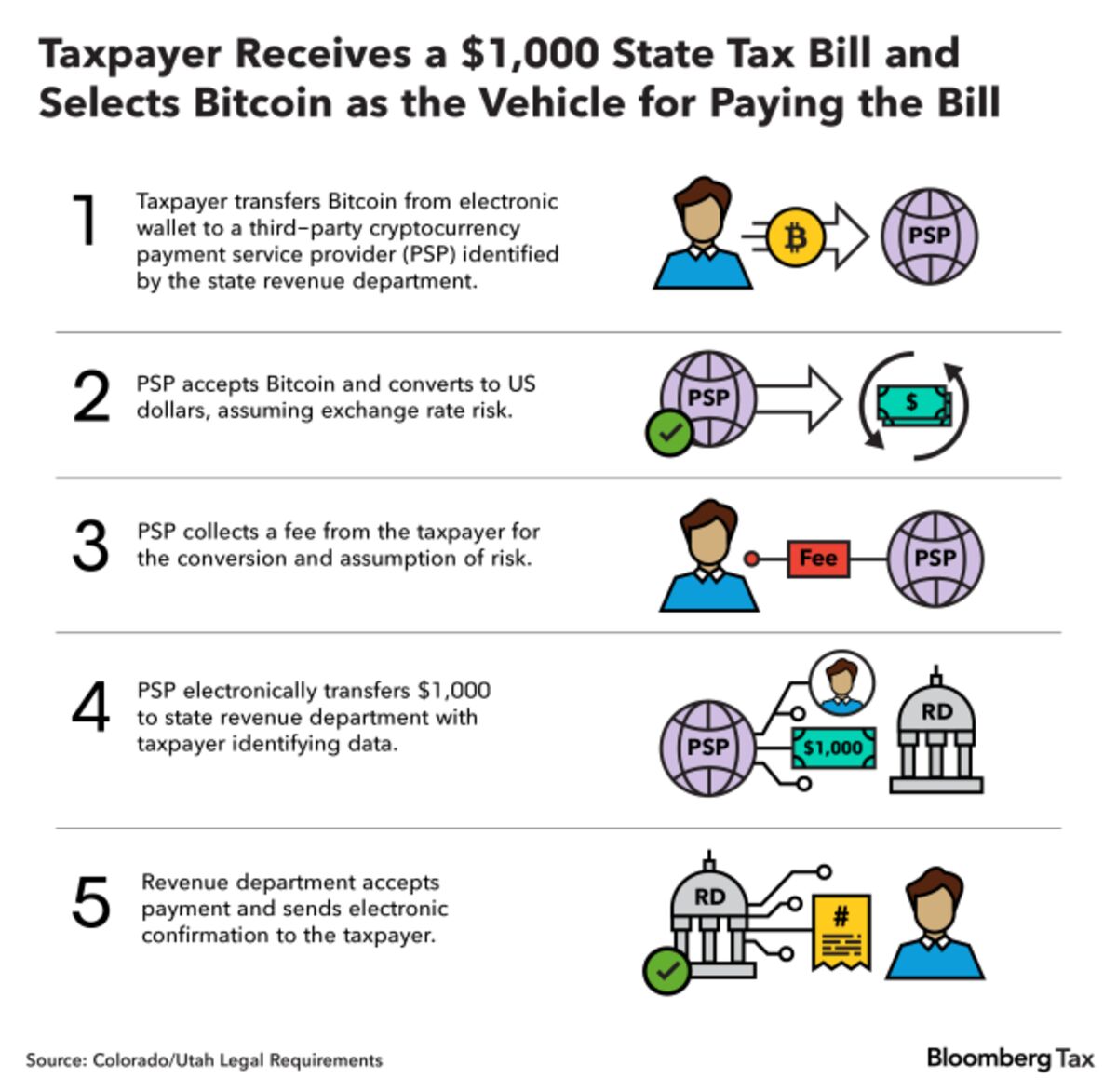

Crypto Crash Weighs On States Plans For Tax Payment By Bitcoin Bloomberg

Pin On Your Government World Events

Why Reusing Bitcoin Address Can Lead To Private Key Theft In 2022 Bitcoin Business Bitcoin Transaction Bitcoin Faucet

Cryptocurrency Tax Calculator Forbes Advisor

Cryptocurrency And Taxes Cryptocurrency Tax Podcasts

Formas Libres De Impuestos Para Transferir Bitcoin Y Otras Criptos Opinion De Expertos

A Guide To Common Us Crypto Tax Scenarios By Chandan Lodha Medium

What Is Cryptocurrency How Does Crypto Impact Taxes H R Block

How To Stay Safe And Secure In The Crypto Trade Infographic Cryptocurrency Crypto Money